Unemployed Data Scientist!

They don't own the same depth of data science skills, but automated predictive analytics tools hatch a new breed of 'data scientists' who can produce actionable predictive models.

Businesses don't have access to a souped-up DeLorean that can travel to the future and back. So the next best and most accessible time machine is none other than predictive analytics -- and its newest relative, automated predictive analytics.

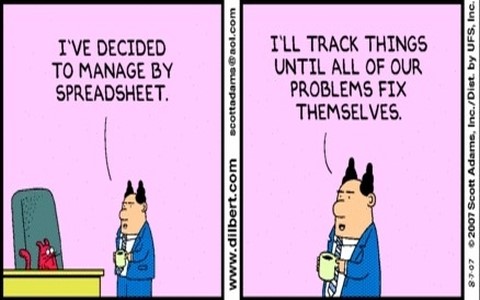

I have always been very much of the opinion that data science is best left to data scientists. But there is a new trend and a group of analytic platform developers who are driven to deliver One-Click Data-In Model-Out functionality. In other words, fully Automated Predictive Analytics.

This topic is too broad for one article. One may have thought that the broader issue is whether or not predictive analytics can actually be automated. Yes, It can. Depends on how we look at it. Given the pace and depth of changes in the industry, in the next 3-5 years the process may be fully automated. When you examine some of the companies who deliver these solutions, you'll see that boat has sailed.

So What Exactly Is Automated Predictive Analytics ?

Automated Predictive Analytics are services that allow a data user to upload data and rapidly build predictive or descriptive models with a minimum of data science knowledge.

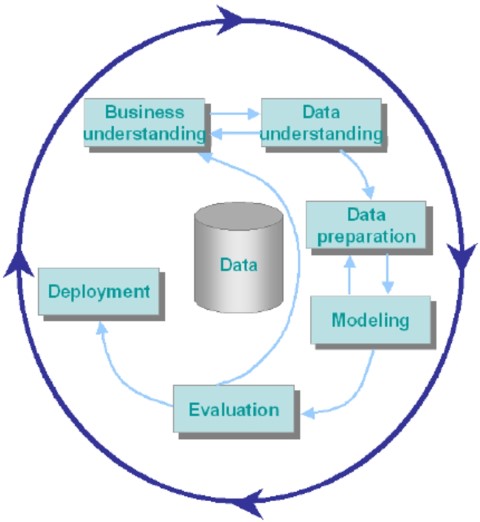

There is an element here of trying to make the data user more efficient by automating the tasks that are least creative. Much of that is in data cleansing, normalizing, removing skewness, transforming data for specific algorithm requirements, and even running multiple algorithms in parallel to determine optimized models.

The good news is that automated predictive analytics tools are gaining acceptance and penetration at an ever expanding rate. It's also a compelling motive that while most data scientist have settled in on the one or two automated analytics tools, they prefer to use that this new expanding market does not come with that baggage. To sell here will not require displacing SAS or SPSS or any of the other heavy hitters since those tools don't meet the needs of these new users. However, ever since Gartner seized on the term "Citizen Data Scientist" and projected that this group would grow 5X more quickly than data scientists, analytic platform developers have seen this group possessing a minimum of data science knowledge as a key market for expansion.

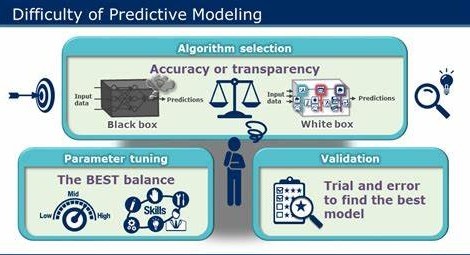

These tools are gaining popularity, because the software solutions have been focusing on the "sexy" Machine Learning (aka Modelling) stage of Predictive Analytics. Modelling has always been quick and takes only a small fraction of the project time, hence any improvements in that stage have a marginal impact on the entirety of project effort and timelines.